Search Results for "digital bond"

FUSANG Exchange Announces CCB $3 Billion Digital Bond Listing Suspended

FUSANG exchange announced that the listing of the $3 billion digital bond backed by China Construction Bank has been suspended.

Bank of Thailand Completes Digital Bond Issuance With Blockchain

Thailand’s apex bank, the Bank of Thailand has leveraged the power of blockchain technology to launch a platform for government bond savings issuance

FUSANG Exchange Lists First Publicly Available Blockchain-Based Digital Bond Backed by CCB

Asia’s first digital security exchange FUSANG is partnering with heavy weight China Construction Bank (CCB) to offer the first ever digital, tokenized, blockchain-based bond.

StanChart and UnionBank of the Philippines Collaborate on PoC of $187 Million Blockchain-Powered Bond

The UnionBank of the Philippines and Standard Chartered have created a proof of concept required in the issuance of a blockchain-powered retail bond.

Citi Partners with World Bank on Euroclear's DLT Platform for Digitally Native Note Issuance

Citi's Issuer Services acted as the Issuing and Paying Agent for the first Digitally Native Note (DNN) issuance via Euroclear's D-FMI distributed ledger technology platform, marking a significant step in digital bond issuance and showcasing a scalable model for blockchain integration within existing capital market structures.

DBS Bank Issues $15M Digital Bonds through DBS Digital Exchange

Singapore-based DBS Bank announced the issuance of digital bonds worth 15 million SGD (US$11.3 million) in its first security token offering (STO).

Malaysia's National Stock Exchange Conducts Blockchain PoC to Digitize Bond Market

Malaysia’s national stock exchange, Bursa Malaysia will conduct a blockchain Proof-of-Concept (PoC) dubbed "Project Harbour" to explore the DLT management of the country’s bonds market.

Bitcoin Becoming More Mainstream While Bond Trading Is Dying, Says Australian Investment Firm

Pendal Group investment management company has announced that it is now in the Bitcoin business. It is taking a stake in Bitcoin through futures contracts.

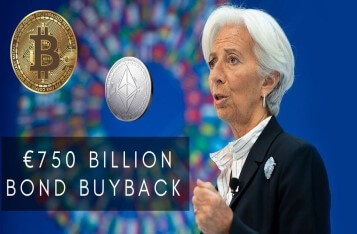

Christine Lagarde Announced EUR 750 Billion Bond Buyback, Bitcoin Surged 10%

With the launch of ECB's €750 Billion bond buyback, Bitcoin, in the last 24 hours witnessed a steep increase in price clocking at 16% growth.

Australian Judge Allows Plaintiff to Use Bitcoin as Collateral Bond

In Australia, a New South Wales (NSW) court has allowed a cryptocurrency exchange account to be used as a collateral bond for legal costs.

Billionaire Bond Manager Jeff Gundlach Says Bitcoin Looks Like A Bubble Waiting to Burst

Jeffrey Gundlach, bond fund manager, said in a recent interview with CNBC that Bitcoin is starting to look like a bubble after it surged above the $23,000 level.

Exclusive | FUSANG CEO: CCB’s $3 Billion in Blockchain-Based Debt Bonds is Rise of Crypto 2.0

According to FUSANG CEO Henry Chong, the CCB's historic blockchain-based bond listing, the first tranche of $3 billion in debt, marks a transition into what he calls “Crypto 2.0”